Import Volumes in 2023

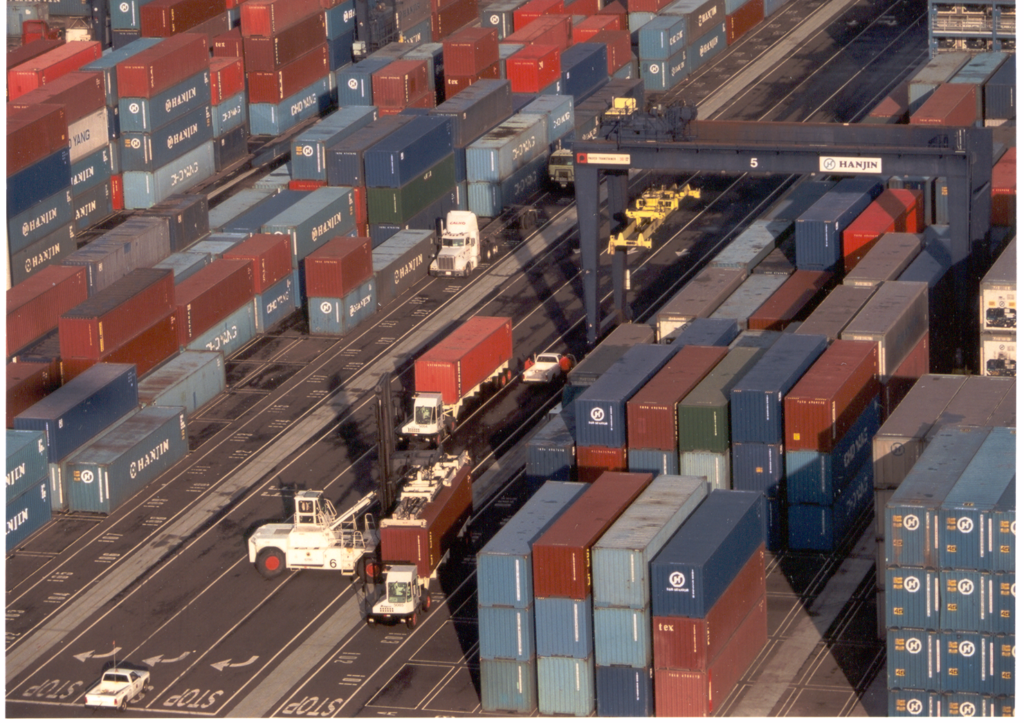

U.S. imports in 2023 fell about 13% from 2022 levels, returning to approximate pre-pandemic 2019 levels (Mongelluzzo 2024). The 2023 total was 24.2 million TEUs, (a united equal to twenty-foot container) compared to nearly 28 million TEUs in the previous two years (JoC.com February 2024). Imports from Asia in 2023 totalled 16.2 million TEUs. This was above the 2019 level (15.9 million TEUs) but below the more than 18.5 million TEUs in 2022 and 2021 (Mongelluzzo 2024).

This decline in imports from Asia reflected trends in the first months of 2023. This trend reversed sharply in October; during that month, containerized imports were 12.4% higher than in October 2022, even 1.1% higher than in pre-COVID October 2019 (Mongelluzzo, 2023). The upward trend continued through November: U.S. imports from Asia that month were 10.8% higher than the same month in 2022 (Journal of Commerce).

New Shipping Routes = More Possible Pests

Proposed new shipping routes will expand the range of pests that can be introduced to eastern ports. For example, in November 2023, the Indian company Ocean Network Express announced plans to begin direct shipments from India to the Ports of New York-New Jersey, Savannah, Jacksonville, Charleston, and Norfolk. Expected cargo includes electronics, apparel, textiles, and foods. (Angell, 2023a) Have USDA authorities evaluated what pest species might be introduced from India?

Traders also expect rising trade volumes from South America in response to shifts in supply chains. Industries include textiles, pharmaceuticals, renewable energy, information technology, and agriculture.

The U.S. is importing more chilled produce from the west coast of South America to meet demand when these fruits are out-of-season in the U.S. The number of refrigerated containers rose to 395,572 TEUs (equivalents of twenty-foot containers). (Knowles. 2023) The Port of Savannah is actively courting these imports; it can now handle more than 3,000 refrigerated containers at one time and is expanding its capacity (Griffis 2023). Chile has a Mediterranean climate similar to that of California; Dr. Mark Hoddle reports several pests of avocado are found in neighboring Peru.

Problems in the canals likely to push trade from Asia back to California ports

In an editorial published on January 25, 2024, The Washington Post reports that drought has caused water levels in the Panama Canal to fall below what is needed to operate the locks. In normal years, about 5% of global maritime trade passes through the canal. This includes nearly half the containers shipped from northeast Asia to the eastern United States. The reduction in numbers of ships moving through the Canal has affected supply chains in agriculture and energy. The situation is further complicated by wars in the Middle East hampering shipments through the Suez Canal.

The Post describes the Panamanian government’s efforts to buttress the canal, which is a major source of income. Droughts elsewhere are also impeding transport, e.g., the Amazon, Rhine, and Mississippi rivers. In the Post’s view, “threats to global growth will make it harder to … respond to poverty and hunger. … Ultimately, prevention, by arresting the emission of planet-warming greenhouse gases, is the only way to stop the list of looming climate-related threats to the global economy from getting even longer.”

Here, my focus is on what this means for volumes of ships and containers visiting ports in the eastern United States – and the associated risks of pest introductions.

Ambitious Plan for Eastern Ports

As I have pointed out in previous blogs [on the website home page, scroll below the “Archives” to “Categories”, click on “wood packaging”, especially this one], ports in eastern and Gulf Coast states have been eagerly conducting dredging operations and making other preparations to attract large container ships bringing goods from Asia. As of just a few months ago, several ports had ambitious plans. The Port of Virginia will reach a depth of 55 feet this year (Angell, 2023b). The Port of Charleston already has a 52-foot depth. Nevertheless, the port authority hopes to further deepen the channel so that it can quintuple its capacity over a decade — from 500,000 TEUs to 2.5 million TEUs (Anonymous, 2024). The Port of New York-New Jersey has approved $19 million to study deepening the ship channels from 50 to 55 feet. The Port Authority hopes to persuade Congress to share the costs (Angell, 2023b). None of the reporting mentions any consideration of the possible pest risk despite past disasters – e.g., introduction of the redbay ambrosia beetle to Savannah or Asian longhorned beetle to Charleston.

The proportion of total U.S. imports going to West Coast ports in 2023 was 53.6% (Mongelluzzo, 2023). Journal of Commerce’ long-time analyst Bill Mongelluzzo expects the effective closure of both the Suez (attacks on shipping) and Panama canals will push more imports from Asia to the Ports of Los Angeles and Long Beach. These linked ports now handle 32% of all U.S. imports. Mongelluzzo expects the increased volume to create new congestion problems (Mongelluzzo 2024).

SOURCES

Angell, M. 2023a. ONE readies Indian-U.S. East Cost service as part of 2024 network rollout. Journal of Commerce. November 27, 2023.

Angell, M.2023b. NY-NJ port takes next steps to study dredging amid larger ship calls. Journal of Commerce December 20, 2023. https://www.joc.com/article/ny-nj-port-takes-next-steps-study-dredging-amid-larger-ship-calls_20231220.html?utm_source=Eloqua&utm_medium=email&utm_campaign=CL_JOC%20Daily%2012%2F21%2F23%20Non-Subscriber_PC00000_e-production_E-165003_DS_1221_0617

AnonymoU.S.. SC Ports requests study to deepen channel leading to North Charleston Terminal. Journal of Commerce Daily Newswire. January 12, 2024

Griffis, T.E. 2023. New ZIM service takes advantage of Savannah’s expanding cold storage network. Journal of Commerce. September 22, 2023.

Hoddle. M.S. 2023. A new paradigm: proactive biological control of invasive insect pests. BioControl https://doi.org/10.1007/s10526-023-10206-5

Knowles, G. 2023. Sourcing shift caU.S.es surge in South American logistics investment. Journal of Commerce. September 25, 2023.

Mongelluzzo, B. 2023. U.S. imports from Asia hit 2023 high in October despite muted peak season. Journal of Commerce.

Mongelluzzo, B. 2024. U.S. imports from Asia fell near pre-COVID levels in 2023, but uncertain ’24 awaits. Journal of Commerce. January 19, 2024.